Singapore’s economy performed strongly in 2021, recouping from losses of the previous year as people began to adapt to covid and businesses’ confidence rebounded. The average pay per view is between s$0.0013 to s$0.004.

Simple How Much Should You Earn In Singapore References, If you want a buffer and don’t want to ‘spend’ your entire tdsr quota on the home loan, you can adjust downwards. In the labour force in singapore 2021 report, we can see the median monthly salary for singaporeans within each age group.

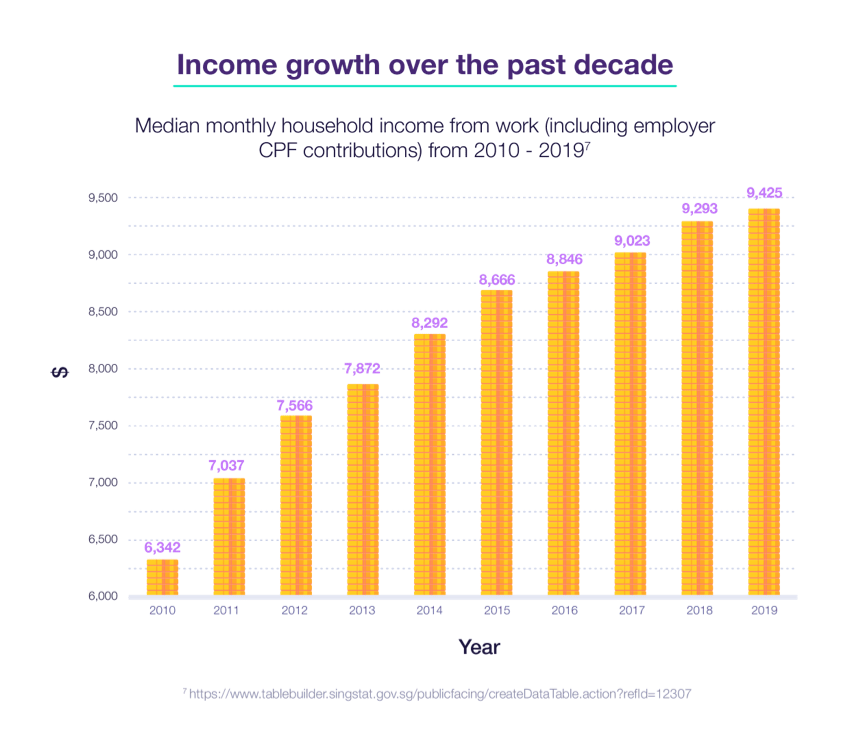

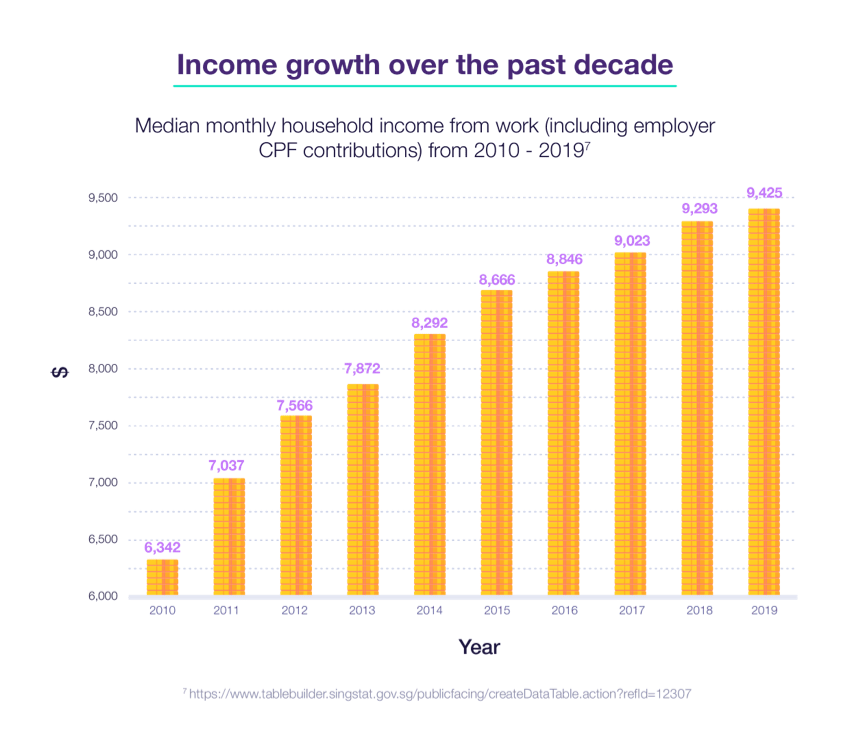

Are you earning enough? Singapore’s average household revealed From sc.com

Are you earning enough? Singapore’s average household revealed From sc.com

Given a 2.18% interest rate, if you took out 60% of the total car cost in loans, you�ll need to pay s$1,412.63 per year in interest. The loan amount needed to finance car costs in singapore is regulated by the mas. As of jan 2022, the average salary in singapore is s$5,783 per month. Government support schemes like the.

Are you earning enough? Singapore’s average household revealed In the labour force in singapore 2021 report, we can see the median monthly salary for singaporeans within each age group.

For the purpose of calculating how much savings we should have, we will use the personal savings rate of 30.2%. After cpf, this comes to about $3,650. Minimum income needed (based on 60% tdsr. These are 5 cheapest cars you can buy in singapore right now.

Source: businessinsider.com

These are 5 cheapest cars you can buy in singapore right now. As you can only take up to a maximum of 7 years to pay off your car loan in singapore, you would need to be able to allocate a total of s$10,669.68 a year toward repayment including interest, or s$889.14 a month. After 10 years, you can sell to anyone, including foreigners. Countries Where Teachers Get Paid More Business Insider.

Source: ifunny.co

Source: ifunny.co

You should not own or have disposed of any other property, whether in singapore or overseas within the last 30 months, and you haven’t bought an ec, hdb and/or dbss flat, or received a housing grant prior to applying to buy an ec. These are 5 cheapest cars you can buy in singapore right now. I am placing around 10% of my emergency fund inside, which will help me to pay for any immediate emergencies. WHY YOU SHOULD WEAR FACEMASKS ME TRY AND MAKE IS SIMPLE FOR YOU sg) IF.

Here’s an alternative way to look at it: If you spend an average of $60 per week on petrol, this adds up to $240 per month. Gdp growth reached 15.2% in q2 of 2021 and 7.1% in q3, higher than initially anticipated. How much money do I need to live comfortably in Singapore and save.

Source: businessinsider.com.au

Source: businessinsider.com.au

Minimum income needed (based on 60% tdsr. Highlights from the 2022 singapore salary guide: Gdp growth reached 15.2% in q2 of 2021 and 7.1% in q3, higher than initially anticipated. There�s a simple calculation to determine how much you need to have.

Source: salary.sg

Source: salary.sg

After 10 years, you can sell to anyone, including foreigners. From this, we can also see that a couple buying a condominium outside central regions (ocr) may only need to earn $4,063 each while another couple buying an ec (executive condominium) will have to be earning close to $5,764 each. For a complete guide to hdb housing grants you may be eligible for in singapore, you can read this article. Calculate How Much Savings You Should Already Have Salary.sg Your.

Source: thefinance.sg

Source: thefinance.sg

If you are trying to find out the minimum income you need to earn, then legally you can use up to 60% of your income on the mortgage (assuming you have no other debts). How much do you need to earn to own a ferrari in singapore? The typical singaporean makes around $4,563 a month. Should You Get Wedding Insurance? TheFinance.sg.

Source: singaporerealestateinsider.com

Source: singaporerealestateinsider.com

40% of youtube channels with a million subscribers make over six figures annually. After 10 years, you can sell to anyone, including foreigners. Realistically, we don�t think singaporeans should be spending more than 10 to 20 per cent of their annual income on a car. Buy House in Singapore? Click Here to Find Out If You Can Afford It.

Source: sc.com

Source: sc.com

Discuss your views with us on facebook. Or do you think singaporeans can afford to buy a car even with a lower income? Join our telegram channel (7000+ subscribers) for daily market analysis & trading tips: Are you earning enough? Singapore’s average household revealed.

Source: marketwatch.com

Source: marketwatch.com

Office) and this could easily be a further $80, with the exact cost depending on where else you park each day. Realistically, we don�t think singaporeans should be spending more than 10 to 20 per cent of their annual income on a car. Discuss your views with us on facebook. How much money will gold medal winners in Rio take home? MarketWatch.

Source: blog.seedly.sg

Source: blog.seedly.sg

The typical singaporean makes around $4,563 a month. Assuming you save 20% of this (an average savings amount), you would stash away $730 a month. 40% of youtube channels with a million subscribers make over six figures annually. How Much of Your NS Allowance Can You Save During National Service?.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

For a complete guide to hdb housing grants you may be eligible for in singapore, you can read this article. For the purpose of calculating how much savings we should have, we will use the personal savings rate of 30.2%. Let’s say you’ve saved this amount since you started working at the age of 25. Complete Guide To HDB Housing Grants In Singapore For Different Types.

Singapore’s economy performed strongly in 2021, recouping from losses of the previous year as people began to adapt to covid and businesses’ confidence rebounded. If you are trying to find out the minimum income you need to earn, then legally you can use up to 60% of your income on the mortgage (assuming you have no other debts). Given a 2.18% interest rate, if you took out 60% of the total car cost in loans, you�ll need to pay s$1,412.63 per year in interest. What is the salary comparison between NYC and Singapore? How much.

Source: zuuonline.sg

Source: zuuonline.sg

After cpf, this comes to about $3,650. T.me/synapsetrading forbes has named singapore as the third richest country in the world. In the labour force in singapore 2021 report, we can see the median monthly salary for singaporeans within each age group. How Much should you Earn, Before you can Buy a Luxurious Condominium in.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Your household cannot earn more than $16,000 a month. Let’s say you’ve saved this amount since you started working at the age of 25. T.me/synapsetrading forbes has named singapore as the third richest country in the world. How Much Should You Earn In Singapore Before You Think About Buying A Car.

Source: mainlymiles.com

Source: mainlymiles.com

For a start, if you live in a hdb block, parking will cost you a minimum of $110 per month. After 10 years, you can sell to anyone, including foreigners. Discuss your views with us on facebook. Last 3 days Should you book Singapore Airlines and SilkAir flights.

The Average Pay Per View Is Between S$0.0013 To S$0.004.

Add in the cost of parking elsewhere (e.g. For a start, if you live in a hdb block, parking will cost you a minimum of $110 per month. After 10 years, you can sell to anyone, including foreigners. 40% of youtube channels with a million subscribers make over six figures annually.

However, If The Car Has An Omv Less Than $20,000, You Could Borrow A Maximum Of 70% Of The Car’s Total Purchase Price.

But unless you are well within the top 1% of income earners in singapore, and really enjoy the attention of driving a supercar at snail like pace on our roads, it would be best for you to find. Given a 2.18% interest rate, if you took out 60% of the total car cost in loans, you�ll need to pay s$1,412.63 per year in interest. T.me/synapsetrading forbes has named singapore as the third richest country in the world. As you can only take up to a maximum of 7 years to pay off your car loan in singapore, you would need to be able to allocate a total of s$10,669.68 a year toward repayment including interest, or s$889.14 a month.

Highlights From The 2022 Singapore Salary Guide:

Discuss your views with us on facebook. The post how much should you earn in singapore before you think about buying a car appeared first on dollarsandsense.sg. The loan amount needed to finance car costs in singapore is regulated by the mas. You should not own or have disposed of any other property, whether in singapore or overseas within the last 30 months, and you haven’t bought an ec, hdb and/or dbss flat, or.

For Example, If You Intend To Purchase Open Market Value Cars Above $20,000, The Law Allows You To Borrow Up To 60% Of The Total Purchase Price;

If you are trying to find out the minimum income you need to earn, then legally you can use up to 60% of your income on the mortgage (assuming you have no other debts). As of jan 2022, the average salary in singapore is s$5,783 per month. Your household cannot earn more than $16,000 a month. In the labour force in singapore 2021 report, we can see the median monthly salary for singaporeans within each age group.